There are a myriad of reasons why Software as a Service (SaaS) has rapidly gained in popularity over the last 20-plus years: Affordability, scalability, flexibility, and more. The list goes on and on, but most notably, SaaS has transformed how businesses access and use software.

While customers benefit from customer-centric SaaS subscriptions, self-service, and pay-as-you-go business models, accounting teams are left trying to account for various renewal options, plan changes, and payment terms. To further complicate accounting, revenue recognition can feel pretty overwhelming in a SaaS environment unless automation solutions are in place. Since revenue recognition should be spread out over the duration of the subscription rather than being recognized upfront, as in traditional software sales, recognizing revenue isn’t always straightforward.

Amidst all this complexity is generating accurate revenue metrics like ARR, MRR, deferred revenue, and remaining performance obligations (RPO). But one metric in particular, RPO, becomes a key metric for SaaS companies to understand how much revenue they have committed to delivering in the future. RPO shows a company’s future revenue trajectory and momentum by representing the total value of unfulfilled contractual commitments (performance obligations). US public companies are required to disclose this metric in their financial statements, and others do so simply to provide their stakeholders with visibility.

This guide fully explains the concept, significance, and implications of the remaining performance obligation (RPO) metric. In addition, it dives into all the details surrounding performance obligations, why the RPO metric is so important to SaaS companies in particular, how to calculate it, and more.

With this information, accounting teams can move forward confidently, generating transparent financial reporting with revenue metrics that offer investors and other stakeholders valuable and strategic insights.

What Is a Remaining Performance Obligation (RPO)?

A remaining performance obligation (RPO) represents the revenue a company expects to recognize from outstanding contractual obligations with its customers in the future. Guided by Generally Accepted Accounting Principles (GAAP) and mandated by ASC 606, the RPO metric shows the value of contracted services yet to be delivered or performed.

Put another way, RPO is the sum of deferred revenue (advance payments for services that still need to be delivered) and backlog (future earnings from contracts that haven’t been invoiced yet). It’s an indicator of a company’s future growth.

In the context of SaaS businesses, RPO typically refers to unfulfilled commitments over a specified period within a subscription. It often includes contracted elements like ongoing support, maintenance, or additional features promised to customers beyond the current reporting period.

It’s critical that companies track RPO because of its impact on SaaS revenue recognition. It enables businesses to gauge their future revenue stream and predict cash flow so they can make educated decisions related to financial planning and resource allocation.

Monitoring RPO also helps companies make sense of their customer retention and satisfaction levels. It offers insights into the potential revenue generated from existing contracts, allowing SaaS businesses to adapt their sales and marketing strategies to improve customer engagement and expand their service offerings to align with customer needs.

Finally, the RPO metric can allow companies to identify potential revenue shortfalls and take steps to address them before they become problematic.

In a nutshell, RPO in the SaaS domain is the monetary representation of pending services owed to customers and is instrumental in revenue forecasting, financial planning, and the development of customer-centric strategies to achieve and sustain growth.

Performance Obligations

Performance obligations are distinct promises in a contract to transfer goods or services. These obligations typically either stand-alone or form part of a series and are individually identifiable. When satisfied, they trigger revenue recognition by transferring a promised good or service to the customer.

Some common examples of performance obligations in SaaS include the following:

- Access to software: Providing access to the SaaS platform itself is a primary performance obligation. This involves granting the user the right to utilize the software for a specific duration.

- Updates and maintenance: SaaS companies often include continuous updates, patches, and maintenance services in their offerings. These represent an ongoing obligation to the customer while ensuring the software remains functional, secure, and up-to-date.

- Customer support: Customer support services such as technical assistance, troubleshooting, and user guidance are another potential performance obligation. These help users maximize the value of the software by addressing any issues they encounter.

- Data security: Assuring the security and integrity of user data is a crucial obligation. SaaS providers often commit to implementing robust security measures and maintaining data confidentiality.

- Service Level Agreements (SLAs): Guaranteeing a certain level of performance, uptime, or availability is another typical obligation. Meeting agreed-upon SLAs helps ensure the service performs as expected, providing reliability to customers.

- Customization services: Tailoring the SaaS platform so it meets specific customer needs or integrating it with other systems is often an additional performance obligation provided as a service.

These performance obligations collectively form the contractual commitments between SaaS providers and their clients. They ultimately describe the services that will be provided and the expectations for their delivery.

Time-Based and Usage-Based Obligations

Performance obligations can be either time- or usage-based. What’s the difference? Time-based obligations are tied to specific timeframes where services or deliverables are provided over a defined period, regardless of actual usage.

In contrast, usage-based obligations depend on the actual consumption or utilization of services or products, irrespective of the time taken to use them.

It’s important to note that time-based obligations typically allow revenue recognition over time as services are performed. This is usually done using methods like percentage of completion, which recognizes revenue in proportion to the completion of the obligation.

On the other hand, usage-based obligations can pose a challenge for revenue recognition since they are tied to actual usage or consumption. In such cases, revenue recognition generally happens as the service is used or the product is consumed. In these instances, it’s imperative to accurately measure usage so revenue is recognized properly.

When it comes to financial reporting, time-based obligations can be preferable because they often result in a steadier, more predictable revenue stream over the contract period. Alternatively, usage-based obligations frequently lead to variability in revenue recognition GAAP periods and amounts since they rely on actual utilization by the customer.

To sum it all up, time-based obligations deliver over a specific period, allowing for consistent revenue recognition, while usage-based obligations depend on consumption, making revenue recognition more variable and contingent on usage metrics.

Why Are RPOs Important in SaaS Companies?

One of the primary reasons the RPO metric is so invaluable to SaaS companies is that it enables them to show investors their anticipated future revenue. This is key, especially for businesses with long sales cycles. The visibility that RPO provides is crucial for forecasting and planning.

As a reminder, SaaS businesses want to have the ability to display growth so they can attract investments by demonstrating scalability and future revenue potential, which is vital to securing funding, expanding operations, and sustaining a competitive edge in the market.

Here are some other ways RPO benefits private and public SaaS companies.

Revenue Recognition Implications

There’s no getting around the fact that RPO impacts revenue recognition for SaaS and software companies. After all, it measures and reflects the revenue the company expects to recognize in the future.

In SaaS, revenue is recognized over time as the service is delivered. Hence, when RPO increases, it typically means future revenue will still be earned from existing contracts. On the other hand, RPO decreases as services are rendered or delivered, leading to revenue recognition as performance obligations are met.

Therefore, a higher RPO might indicate more future revenue but doesn’t immediately impact revenue recognition in the current reporting period. As an enterprise SaaS company fulfills its obligations, revenue is recognized, affecting its financial reporting.

Although the metric doesn’t appear on the balance sheet or income statement, it’s usually included in the disclosures of a company’s financial statements. Born of revenue standard ASC 606, substantial RPO numbers can impact financial reporting and investor perceptions.

When SaaS companies take measures to properly manage their RPO and adhere to accounting standards (RightRev’s ASC 606 revenue recognition guide helps with this), they ensure that their revenue is reported accurately over time, bolstering investor trust and avoiding misleading financial reporting.

Business Planning and Forecasting

SaaS firms often rely on RPO data to project revenue and plan for the future. This metric brings to light upcoming revenue streams so a company can allocate its resources appropriately and refine its business strategies. In addition, when a business understands its committed deliverables, it can anticipate income, improve strategic decision-making, and optimize its operations to meet future obligations.

Looking at RPO in conjunction with other data points, a SaaS company can also potentially capture various insights into customer preferences and renewal patterns, enabling it to tailor its marketing, product development, and customer engagement strategies so they align with anticipated revenue streams and customer needs.

RPO disclosures by public companies can also be monitored for trends in contract duration, providing an understanding of a service’s stickiness.

Easy for Investors to Understand

One of the nice things about RPO is that it’s relatively simple, making it an easier metric for investors to decipher and comprehend. This is in comparison to billings, a non-GAAP metric, which is typically found on financial statements.

Billings doesn’t take deferred revenue changes into account. Because of this, it becomes necessary to reconcile billings and reported GAAP revenue, which can get confusing for investors.

RPO, on the other hand, gives investors a more straightforward number to look at when considering a company’s future revenue.

A Leading Indicator of Revenue

RPO is a useful tool for forecasting future revenue because it displays the sum of both invoiced and uninvoiced business. Many SaaS companies further refine this metric with cRPO (current remaining performance obligations), representing the portion of RPO expected as revenue in the next 12 months. This growth marker denotes billings and revenue within that span.

Public SaaS entities often supplement RPO on their financial statements with the billings metric (mentioned above), aiming to increase revenue visibility. This might become less common in the future, however, as RPO takes over as a leading revenue indicator because it’s easier to understand and offers more clarity.

Meanwhile, privately-backed SaaS firms frequently use the TCV-to-ACV ratio to estimate future revenue. But, again, RPO offers revenue quantification without this calculation, which can appeal to VC investors seeking growth insights.

Finally, backlog, which refers to contracted but uninvoiced funds, is included in RPO calculations, which can be helpful to SaaS firms that want to depict revenue to investors concerned about ARR. RPO’s clarity and predictive potential may drive its increased utilization in the future.

Accounts for More Business Models

SaaS companies offer diverse pricing models and billing frequencies. Fortunately, the RPO metric transcends all these different pricing and business structures in order to present a more comprehensive outlook for investors.

On the other hand, when the billing metric is reconciled back to revenue, it looks at changes in deferred revenue, not backlog. As a result, when a company adjusts the frequency of its subscription billings, thereby distorting deferred revenue, it leads to inaccurate and misleading billing numbers.

Unlike billings (which only focus on deferred revenue), RPO includes deferred revenue and backlog so it can portray future revenue correctly despite any changes to the subscription term.

RPO Calculation (How to Calculate RPO)

RPOs are a required financial disclosure for US public companies in the financial statements they file with the SEC for ASC 606 compliance (per ACS 606-10-50-13—Transaction Price Allocated to the Remaining Performance Obligations). The contract value minus the revenue recognized determines the RPO for a contract.

RPO = Contract Value – Revenue Recognized

Below is an examination of the RPO calculation and some related components.

An Example of an RPO Calculation

Let’s say a SaaS company sells a 12-month subscription to its software for $12,000. The customer pays upfront for the entire subscription at the beginning of the contract term. The contract value is $12,000.

At the beginning of the first month of the contract, the company would recognize $1,000. The remaining performance obligation RPO is $11,000 since the SaaS provider still needs to fulfill its obligations under the remainder of the contract. A portion of the $11,000 remaining performance obligations may be planned or unplanned revenue.

The company would then recognize revenue of $1,000 per month over the next 11 months as it fulfills its obligations by providing access to the software to the customer. The remaining performance obligation would diminish by $1,000 each month until the end of the contract.

ance obligation for that contract would diminish by $1,000 each month until the end of the contract.

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | |

| Revenue Recognized | $1,000 | $2,000 | $3,000 | $4,000 | $5,000 | $6,000 | $7,000 | $8,000 | $9,000 | $10,000 | $11,000 | $12,000 |

| RPO | $11,000 | $10,000 | $9,000 | $8,000 | $7,000 | $6,000 | $5,000 | $4,000 | $3,000 | $2,000 | $1,000 | $0 |

Applying this calculation to every active contract will determine a company’s Total Remaining Performance Obligations.

Total RPO = Total Contract Value – Total Revenue Recognized

Using the same contract example above, let’s say there are 100 customers with the same average annual contract value.

Assuming the company has 100 customers with similar contracts, all starting and ending at the same time, the total contracted value will be $1,200,000 ($12,000 x 100 customers). Let’s assume that as of the end of the current quarter, the company has provided access to the software for the first six months of the contract term, so it still has six months of obligations remaining.

To calculate the RPO for the company, take the total contracted value of $1,200,000 and subtract the revenue recognized to date of $600,000 (6 months x $1,000 per month x 100 customers). This gives an RPO of $600,000.

So, in this example, the company still has $600,000 of remaining obligations to fulfill to its customers over the next six months. That amount will be recognized as revenue in the future as the company fulfills those obligations.

Billings vs. RPO

Billings refer to the invoiced amounts for delivered goods or services, reflecting only what’s been billed to the customer. Meanwhile, RPO tracks the total value of unfinished contracts, including billed and unbilled portions, illustrating the revenue yet to be recognized for unfulfilled obligations.

Annual Recurring Revenue vs. RPO

Annual Recurring Revenue (ARR) represents the predictable annual income from subscriptions or contracts over a period of 12 months (assuming no new business is churned or added), while RPO denotes the total value of unfinished contracts yet to be fulfilled, including future revenues from existing contracts. In other words, ARR reflects current annual revenue, whereas RPO anticipates future revenue from commitments.

Deferred Revenue vs. RPO

Deferred revenue is income received for goods or services that haven’t been delivered yet. Before a company can recognize revenue of this kind, it must be earned. Until then, it’s recorded as a liability on the balance sheet.

In fact, when a company receives an advanced payment, it generally credits deferred revenue and debits cash (a double entry). Later, it can analyze changes in its deferred revenue balance to gather insights into its business performance.

Conversely, RPO signifies contracted but incomplete work that remains in a service agreement. It encompasses unearned revenue and unbilled amounts under contract (also known as backlog).

Annual Contract Value vs. RPO

Annual Contract Value (ACV) refers to the total anticipated revenue from a contract over a year. Unlike RPO, ACV doesn’t consider unbilled amounts or the total contract duration. Instead, it provides public companies with an earnings snapshot for a one-year period, helping them project revenues.

Should You Use RPO?

Accounting standard ASC 606 mandates that public companies disclose any remaining performance obligations (RPO) on their financial statements. Why?

For one, the RPO metric provides valuable information about a company’s future revenue expectations. Perhaps more importantly, however, it conveys this information in a way that’s easy for investors to understand, so financial reporting is more transparent and comparable among SaaS companies.

There has been a shift away from using billings, the metric most commonly used in the past to assess future revenue, toward RPO because it’s simpler and more straightforward. Unlike billings, it’s not impacted when SaaS companies switch subscription frequencies.

How RightRev Can Help

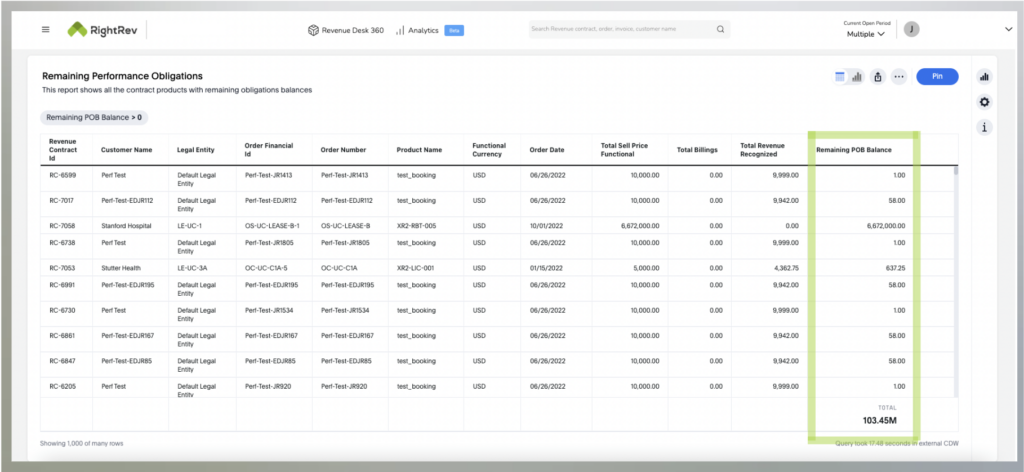

As both public and private companies in the SaaS industry and beyond begin implementing the RPO metric in their financial reporting, it’s absolutely critical they take measures to ensure accurate revenue recognition. Based on this, they can generate timely reports that derive RPOs for planned and unplanned revenue, bolstering investor trust and improving transparency.

The best way to achieve revenue recognition accuracy is by automating the whole process with RightRev. Its pre-defined rules trigger how and when to recognize revenue by product or SKU and apply revenue calculations by performance obligation automatically.

More than that, RightRev will automatically create a revenue waterfall and RPO reports that cover both current and deferred revenue, allowing for amazingly accurate forecasting of undelivered performance obligations.

Request a free demo today and conquer RPO disclosures with ease.

Follow RightRev on LinkedIn to see more rev rec insights.