-

Accounting, Revenue Recognition

Accounting, Revenue RecognitionThe Features That Make RightRev an Advanced Revenue Recognition Software Solution

Started by a pioneer in the revenue recognition automation space, RightRev is built on decades of revenue accounting experience. We’ve taken all of the learnings from building our first revenue solution, RevPro, and used that knowledge to build a truly, next-gen revenue recognition subledger.

-

Accounting, Revenue Recognition

Accounting, Revenue RecognitionRevenue Recognition Use Case for SaaS Companies [Use Case Specific]

SaaS companies are becoming more creative in their contract structures, offering bundled services and discounts, experiencing frequent contract modifications, and utilizing event-based revenue recognition.

-

Accounting

AccountingTop Reasons for Material Weakness in Revenue Recognition

In 2023, 41 SEC enforcement actions involved material weaknesses or revenue misstatements—the highest in recent years. Additionally, 58% of IPOs reported material weaknesses in their initial filings, underscoring systemic issues in financial reporting.

-

Revenue Recognition

Revenue RecognitionBuilding Scalability with a Revenue Reporting System for Complex Business Models

In certain ways, revenue reporting systems function similarly to revenue recognition solutions. They both track revenue to its source, aim to post it to the right account in the general ledger, and are essential to support your company’s financial performance.

-

Accounting

AccountingUnderstanding Audit Procedures for Revenue Recognition

Revenue recognition audits are some of the most stressful parts of accounting, especially when juggling multi-element contracts, variable consideration, and contract terms that seem to change overnight.

-

Accounting

AccountingDeferred Revenue – Accounting, Definition, Example

For companies with annual subscription payments, advance payments, or usage-based pricing, deferred revenue accounting is crucial. And with the increasing complexity of goods or services bundled together, and discounts, getting this right is more important than ever.

-

Accounting

AccountingBreaking Down Revenue Recognition in Accrual Accounting

The accrual accounting method ensures full financial transparency by recognizing revenue upon delivery of the product or service, regardless of whether payment has been received.

-

Accounting, Revenue Recognition

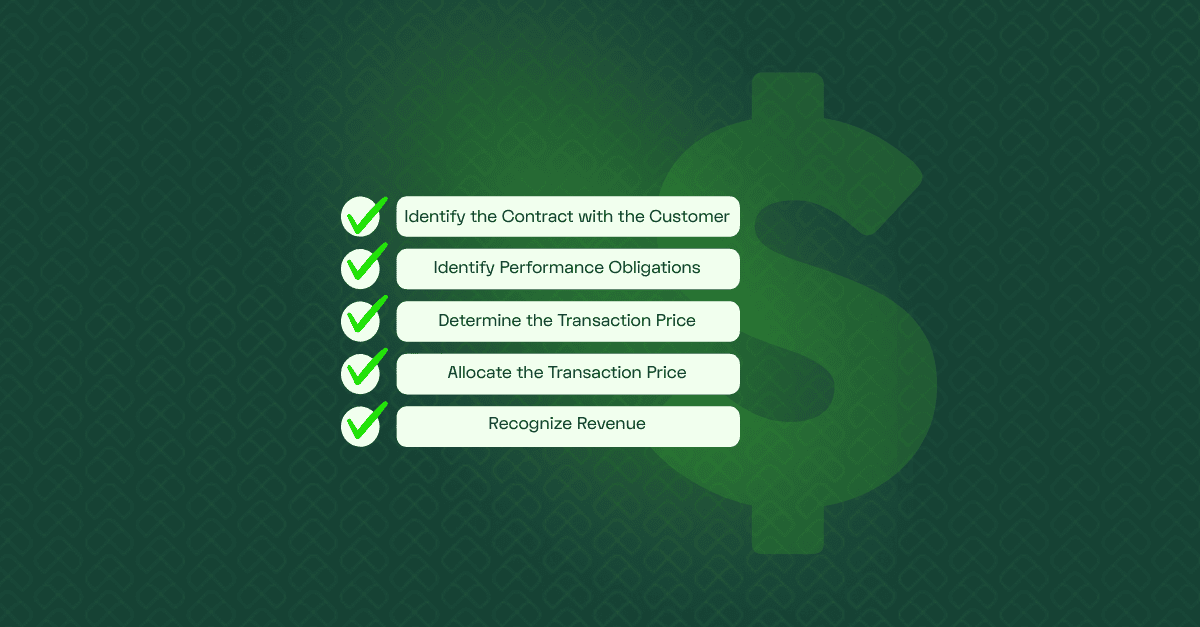

Accounting, Revenue RecognitionRevenue Recognition: What It Means in Accounting

This article explores the principles and challenges in revenue recognition, how accounting teams can handle them, and why automation is the key to overcoming manual errors and inefficiencies.

-

Accounting, Revenue Recognition

Accounting, Revenue RecognitionAn IFRS 15 Guide for Software and SaaS Companies

IFRS 15 lays out the rules for recognizing revenue from customer contracts, but for SaaS companies juggling subscription plans, bundled services, and changing pricing models, applying these rules can feel like navigating a maze.

-

Accounting

AccountingAlternatives to SOFTRAX Revenue Management System

SOFTRAX can offer impressive capabilities in handling some businesses’ invoicing, revenue recognition, and billing processes. Despite these features, according to G2 reviews, users report several challenges that prompt them to explore alternatives.

-

Accounting

AccountingRecurring Revenue SaaS: What CFOs Are Tracking in 2025 for Growth and How Automation Can Help

SaaS Chief Financial Officers (CFOs) play a pivotal role in sustaining growth and revenue. Today’s CFOs go beyond traditional financial management to drive growth, manage risks, and optimize operations across departments while aligning their financial strategies with broader business objectives.

-

Revenue Recognition, Video

Revenue Recognition, VideoMonetizing AI: Back-Office Transformation for AI and Agentic Business Models

AI is transforming the front office—now it’s time for the back office to catch up. In this webinar, experts from RightRev, Salesforce Revenue Cloud, and Norwest Venture Partners explore how leading companies are rethinking billing, revenue recognition, and financial reporting to support usage- and outcome-based models.

Learn how to: Transcript Let’s dive in. AI […]

Revenue Recognition Insights

Your Source for Revenue Recognition Knowledge