Imagine you’re on a scavenger hunt, navigating a path to the treasure, only to find yourself in front of a complex and ever-shifting maze. Each path you choose offers its own set of challenges, from hidden traps to misleading shortcuts. Now, swap out the treasure hunt for revenue recognition, and you’ve got a pretty accurate picture of what many businesses face when trying to manage their revenue reporting. The tools and methods available for revenue recognition each come with their own set of advantages and pitfalls, and finding the right one can feel like searching for buried treasure with a map that’s constantly changing.

Common Approaches to Recognizing Revenue

Revenue recognition is crucial for accurately representing a company’s financial performance and ensuring compliance with accounting standards. Traditionally, accountants relied heavily on spreadsheets to track and calculate revenue recognition, often leading to time-consuming manual processes and potential errors. The introduction of ASC 606 in 2014 significantly changed the landscape of revenue recognition by providing a standardized five-step framework for recognizing revenue across industries. This new standard increased complexity and required more detailed tracking of performance obligations and contract modifications. As a result, many companies find their existing spreadsheet-based systems inadequate for handling the new requirements. This shift prompted the development of specialized revenue recognition software solutions that could automate processes, improve accuracy, and provide real-time insights into revenue recognition. These new tools have helped companies streamline their revenue recognition processes, ensure compliance with ASC 606, and gain better visibility into their financial performance. The top ways accounts calculate revenue recognition are 1) in spreadsheets 2) in their ERP 3) as part of their billing solution 4) a revenue recognition point solutions which handles the widest range of revenue use cases.

In this blog, we’re going to break down the various ways accountants handle revenue recognition—each method akin to a different path in our maze. We’ll compare the traditional approaches, weigh their pros and cons, and guide you through why a specialized solution might just be the treasure map you need to navigate the complexities of revenue recognition with ease.

Manual Methods / Spreadsheets

| Pros | Cons |

|---|---|

| Flexibility: Think of spreadsheets as a trusty Swiss Army knife. You can run revenue calculations in spreadsheets and manipulate the revenue data points as needed by updating formulas or fixing reference table errors manually, albeit with a lot of effort and man-hours. | Time-Consuming: Managing revenue through spreadsheets can feel like you’re perpetually stuck in a never-ending game of whack-a-mole. Managing multiple calculations spread across multiple reference tables is highly manual. Accountants end up spending their time validating calculations and troubleshooting errors rather than analyzing the revenue data. |

| Cost-Effective: From a cost standpoint, using spreadsheets is like cooking at home instead of dining out—you save on software costs but not necessarily on the time and effort required. Microsoft Excel is fairly inexpensive and most organizations already pay for the Microsoft Suite. | Error-Prone: One slip of the keyboard and your carefully balanced data could go awry—we get it–it’s like trying to balance on a tightrope while juggling flaming torches. |

| Low barrier to entry: Revenue recognition in spreadsheets is easy to adopt because of easy access to Excel. Accountants can get started using spreadsheets for revenue recognition in minimal time because it has a low learning curve and most accountants are highly familiar with its functions. | Security Challenges: With multiple people touching the accounting spreadsheets, how can you ensure that the data will remain secure, that nothing will be overwritten, or that the files won’t get hacked? |

| Scalability Issues: As your data grows, spreadsheets can become a cumbersome mess. We hear horror stories of accountants having to use an external hard drive to process the revenue files overnight just so their computer doesn’t crash. Spreadsheets may suffice when a company is just starting, but as your company grows, and contracts become more complex, you will quickly outgrow spreadsheets and need an automated solution to make the most of accountants’ time. | |

| Lack of real-time reporting: Manual processes provide less visibility and real-time reporting capabilities, making revenue forecasting delayed and less accurate. |

ERP Modules

| Pros | Cons |

|---|---|

| Platform Continuity: ERP modules offer the comfort of a familiar home base, integrating seamlessly with your general ledger and core financials. | Not Purpose- Built for Recurring Revenue: Many ERP systems bolt on revenue recognition as an afterthought and struggle to solve recurring revenue use cases. |

| Automation: Almost all ERPs offer some revenue recognition automation–most commonly anywhere from 30-60% automation. The remainder of the tasks are completed outside of the ERP (that’s right, you’re back in dreaded spreadsheets or building workarounds in external applications). | Flexibility Constraints: ERP modules can be rigid. You find yourself spending more time manipulating your data to fit the expectations of the ERP. Again, you’re spending more time fixing the data instead of analyzing it. |

| Reporting: Reporting capabilities are better than those of manual methods, but they are not super robust. | Reporting Gaps: Comprehensive revenue reporting is lacking. Many revenue accountants must combine multiple reports before gaining visibility into valuable revenue metrics like deferred revenue, remaining performance obligations, revenue distributions, etc. |

| Contract Modifications: Most of the time, contract modifications are accounted for outside of the ERP because of its inability to combine contracts and seamlessly allocate revenue if there are any contract modifications like renewals, amendments, or cancellations. |

To read more on the pitfalls of the ERP for revenue recognition, check out this blog: The Importance of the Revenue Recognition Module When Evaluating an ERP.

Billing Software With a Revenue Recognition Module

| Pros | Cons |

|---|---|

| Billing and Revenue Connectivity: Direct connection between AR and revenue functions allows for a wholistic view of billing and deferred revenue. | Invoicing Dependency: Typically ties revenue recognition to invoicing, with limited ability to account for other revenue use cases like project milestones, consumption, percentage of completion, etc. |

| Cost Advantages: Using a single platform for both billing and revenue can be a financial win from an implementation standpoint. | Limited Complex Capabilities: Billing solutions may not have advanced features like cost accounting, carves, contract positions, etc. |

RightRev: A Specialized Revenue Recognition Solution

| Pros | Cons |

|---|---|

| Purpose-Built for any Revenue Model: Designed specifically for simple and complex revenue recognition, RightRev is like having a treasure map that’s detailed and accurate, guiding you through the maze of ASC 606 and IFRS 15 requirements. | System Integration: If using the RightRev Standalone solution, and you wish to integrate directly with upstream data sources or your downstream general ledger, those integrations are not out-of-the-box (yet) but can easily be set up through a data management solution, like FiveTran. However, if you’re a Salesforce CPQ customer, RightRev is native to the Salesforce platform, and revenue data is automatically processed in RightRev from Salesforce Orders. |

| Highly Configurable: Configure revenue to trigger for a number of different performance obligations with pre-built rules. Configure new rules easily with click functionality–no need for custom code. | Potential Overkill for Simple Needs: Businesses with simple, straightforward ratable revenue may not need a specialized software to recognize revenue. |

| Expert-Developed: Created by a “godfather of revenue recognition” and a team of experienced revenue professionals who not only understand revenue recognition but the need for compliance, controls, and highly performant technology. | |

| Scalable and Fast: RightRev is built for hyper-scale. The largest organizations shouldn’t be stifled by speed, agility, or volume. RightRev can process large amounts of data very quickly, which is a requirement needed by growing mid-sized and enterprise companies. | |

| User-Friendly: Our product moto is “Keep it Simple.” When designing RightRev, we built it with the end-user in mind; accountants do not need to understand SQL or Python or write a single line of code. Our interface is intuitive, and all configuration and day-to-day activities can be accomplished with clicks. | |

| Comprehensive Reporting: Offers over 300 revenue metrics and advanced reporting out-of-the-box. | |

| Contract Version Management: Easily manages contract amendments and versions so you can easily see the entire customer journey in a single contract view. |

Conclusion

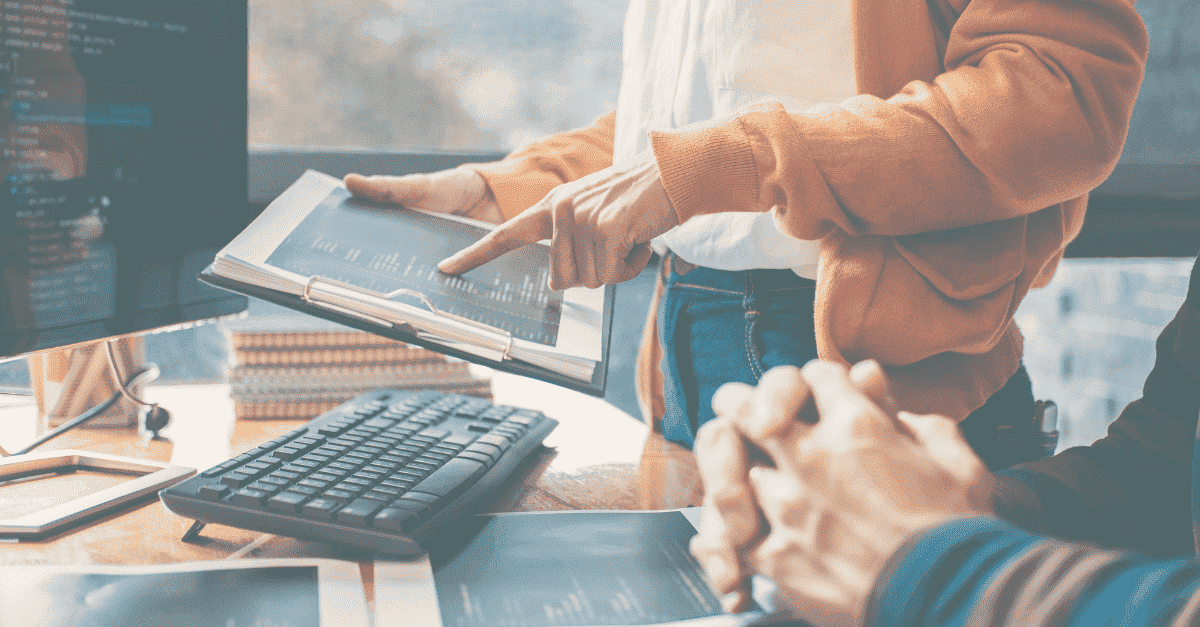

Just as in a treasure hunt, choosing the right revenue recognition tool involves understanding your needs, evaluating your options, and selecting the path that leads to the most efficient and accurate outcomes. Manual methods and basic tools might be sufficient for simpler scenarios, but as complexity and volume increase, they become less practical. ERP modules offer better integration and automation but may fall short in flexibility, complex use cases, and comprehensive reporting. Simple billing solutions streamline processes but might lack the depth needed for complex scenarios.

For businesses navigating the intricate and high-stakes world of advanced revenue recognition, RightRev is the treasure map you need. Its specialized focus, scalability, and expert-backed development make it the optimal choice for overcoming the maze of revenue recognition with confidence and precision. If you’re ready to find your way through the complexities of revenue management, RightRev could very well be the key to your treasure chest of financial success.