Managing revenue isn’t as simple as sending invoices and recording payments when running a software or SaaS business. IFRS 15 lays out the rules for recognizing revenue from customer contracts, but for SaaS companies juggling subscription plans, bundled services, and changing pricing models, applying these rules can feel like navigating a maze.

To stay compliant, finance teams must continually assess performance obligations, allocate revenue correctly, and track contract modifications in real-time. Manual processes can quickly spiral out of control, leading to misstatements, delayed reporting, and unnecessary audit risks. The bigger your company grows, the harder it becomes to manage IFRS 15 compliance with spreadsheets alone.

That’s why software and SaaS companies turn to RightRev. Our IFRS 15 software takes the complexity out of revenue tracking, delivering real-time compliance, accuracy, and scalability.

But how does IFRS 15 impact software and SaaS revenue recognition, and what makes compliance so challenging? Let’s dive into the key factors that make revenue recognition a critical issue—and explore why automation is the future of financial accuracy.

What Is IFRS 15 and Why Does It Matter for Software and SaaS Companies?

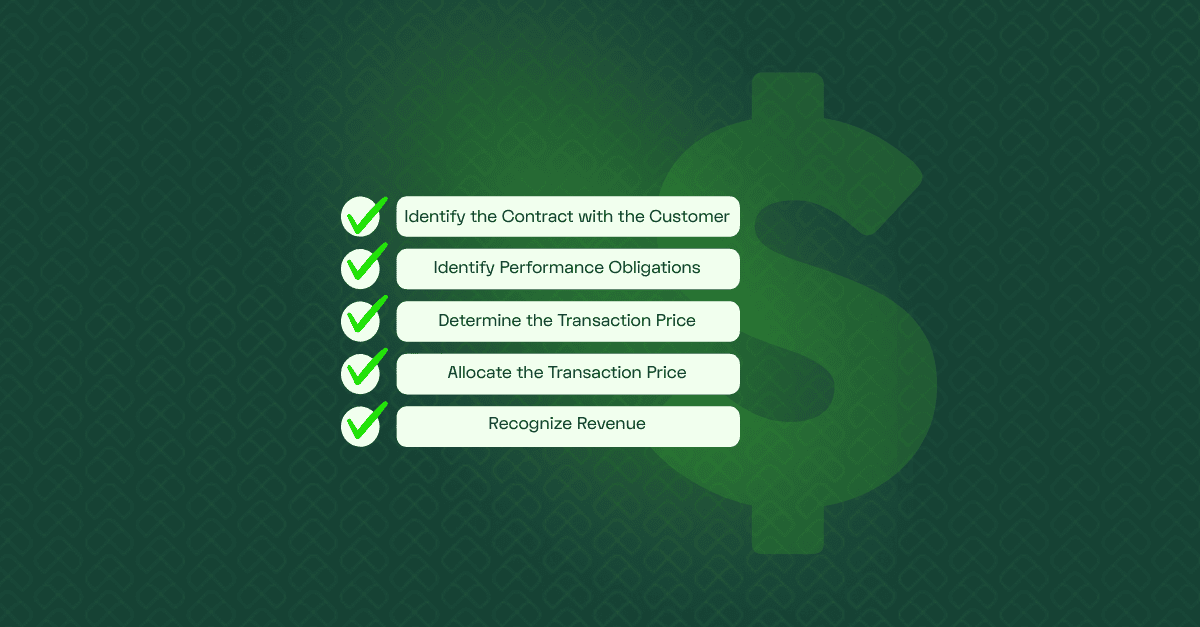

IFRS 15 is the international accounting standard for revenue recognition. It ensures businesses report revenue consistently across industries. By establishing five steps for revenue recognition, IFRS 15 has improved transparency in financial statements and helped investors and regulators compare businesses more effectively.

One of the biggest areas of confusion is the distinction between ASC 606 vs IFRS 15. While both standards follow similar principles, ASC 606 (used in the US) has some nuanced differences in implementation, particularly in areas like contract costs and disclosures. Understanding these variations can be crucial for ensuring compliance.

For SaaS and software businesses, revenue recognition is anything but straightforward. The industry’s reliance on subscription-based models, complex pricing structures, and long-term contracts presents unique challenges under IFRS 15, including:

- Multi-year contracts with performance obligations: Companies must allocate revenue across different deliverables and ensure that each is recognized correctly over time.

- Contract modifications and renewals: Changes in customer agreements, including upgrades, downgrades, or early terminations, require reassessing revenue recognition mid-contract.

- Bundled contracts (software, support, implementation): IFRS 15 requires businesses to separate bundled services and recognize revenue based on their standalone selling price (SSP).

- Usage-based pricing: Revenue recognition fluctuates based on customer consumption, demanding real-time adjustments.

- Subscription-based revenue models: Revenue must be recognized over time rather than at the point of sale, requiring precise tracking and allocation.

Failure to comply with IFRS 15 can lead to misstated revenue, audit issues, and financial restatements, which can cause significant financial and reputational damage. Ensuring accuracy and compliance is crucial, but doing it manually is inefficient and error-prone.

Common IFRS 15 Compliance Challenges for SaaS and Software Companies

SaaS and software companies face distinct hurdles regarding IFRS 15 compliance. Their revenue isn’t tied to one-time sales—it’s an intricate web of subscriptions, performance obligations, usage-based fees, and frequent contract modifications. These complexities make determining when and how revenue should be recognized is challenging.

The following sections will explain how SaaS companies can navigate these complexities effectively and why automation is key to ensuring compliance and financial accuracy.

Handling Complex, Multi-Year Contracts With Renewals and Modifications

SaaS companies often sell multi-year contracts that bundle various professional services, like:

- Software access to provide customers with ongoing functionality

- Onboarding services to ensure a smooth setup

- Ongoing support to assist users and maintain customer satisfaction

While these contracts offer long-term value, they pose certain difficulties when it comes to recognizing revenue for each separate performance obligation. Accurately allocating revenue across bundled services requires careful consideration and consistent application of the relevant accounting standards.

In addition, tracking contract renewals and modifications presents its own set of challenges. These changes can significantly impact revenue recognition and often require finance teams to revisit and adjust previously recorded figures, adding another layer of complexity.

Imagine scenarios like:

- A customer upgrading their plan halfway through the year—how should that additional revenue be accounted for?

- A client downgrading services or adding new features mid-contract.

The impact on revenue streams can be significant, and deciding how to properly allocate or adjust the revenue recognized is no easy task. These complexities mean that revenue data must be meticulously tracked to ensure accuracy.

Relying on manual processes to handle these modifications can introduce flaws and increase non-compliance risk, leading to audit issues and potential financial restatements. Conversely, automation helps SaaS businesses simplify and scale this process while ensuring compliance and reducing risk.

Accurately Allocating Revenue Across Different Performance Obligations

SaaS offerings are frequently sold as bundled packages that combine various services under a single contract. While this approach simplifies things for customers, it can complicate revenue recognition—especially when each component must be accounted for separately. This challenge becomes even more pronounced when similar service combinations appear across multiple contracts.

While bundling services makes revenue recognition easier for customers, it complicates the process for finance teams. Under IFRS 15, companies must allocate the total contract price across these obligations based on their SSP rather than treating them as a single performance obligation.

Here’s why this matters:

- Each component of the bundled package must be tracked separately.

- Revenue is recognized as each obligation is fulfilled.

- Manually breaking down revenue allocation is time intensive and can lead to errors and audit red flags.

The challenge is further exacerbated by:

- Determining accurate SSPs

- Applying SSPs consistently across all contracts

Revenue allocation errors can cause compliance issues, impact the accuracy of financial statements, and increase audit risks. Automating this process helps SaaS businesses reduce their manual workload and ensure compliance with consistent, accurate revenue data.

Managing Variable Considerations (Discounts, Rebates, Tiered Pricing)

Variable consideration refers to the different elements that can impact the transaction price in SaaS contracts, such as:

- Discounts for multi-year commitments

- Usage-based pricing changes as customers consume services

- Rebates are offered when usage or spending thresholds are met

- Performance incentives tied to achieving specific milestones

IFRS 15 requires SaaS companies to estimate and adjust revenue dynamically as customer usage changes. This means finance teams need to predict how much revenue will be recognized based on these variable factors and continuously update their calculations.

Manually tracking these changes can be a minefield. It often leads to:

- Overstated revenue when discounts or rebates aren’t applied correctly

- Understated revenue when performance incentives are overlooked

- Inconsistencies in revenue data that raise audit red flags

For example, a SaaS company offering tiered pricing based on usage might see revenue fluctuate significantly month-to-month. Automating the tracking of variable consideration helps SaaS businesses maintain accurate, real-time revenue recognition and reduce compliance risks.

Tracking Contract Modifications and Changes Over Time

As noted earlier, contract modifications—like plan upgrades, downgrades, extensions, or early terminations—can significantly impact how and when revenue is recognized under IFRS 15. While the concept may sound straightforward, the reality is often far more complex.

Finance teams must carefully evaluate how each change affects previously allocated revenue:

- Upgrades may require reallocation of remaining performance obligations.

- Downgrades or cancellations can trigger revenue reversals.

- Contract extensions might shift timelines and impact future revenue projections.

Managing these changes manually demands constant attention, increasing the risk of errors, revenue misstatements, and compliance gaps. For instance, missing an early termination adjustment could inflate reported revenue, while mishandling an upgrade could lead to understated earnings.

By automating this layer of revenue management, SaaS companies can stay compliant, reduce audit risk, and ensure revenue data remains accurate—even as customer plans evolve.

Ensuring Audit Readiness With Clear Revenue Reporting

SaaS finance teams must maintain transparent, auditable revenue records to pass IFRS 15 compliance checks. This means keeping detailed documentation of how revenue is tracked, allocated, and recognized.

IFRS 15 requires businesses to disclose:

- Revenue disaggregation by product type, geography, and customer segment

- Contract balances, including opening and closing liabilities

- Significant judgments in revenue recognition

- Performance obligations and transaction price allocations

When revenue reports are misaligned, they can lead to serious risks. Accounting teams face constant pressure to ensure that revenue data is audit-ready and meets all disclosure requirements. Errors or inconsistencies in revenue records can damage a company’s financial reputation and result in costly compliance issues.

Through automated solutions, SaaS companies can improve accuracy, streamline revenue reporting, and ensure readiness for audits.

How RightRev Automates IFRS 15 Compliance

RightRev eliminates manual complexity by automating revenue recognition processes, helping accounting teams reduce compliance risks and ensure accurate financial reporting.

RightRev’s key capabilities include:

- Real-time revenue recognition: Designed for SaaS models, RightRev handles subscription, usage-based, and tiered pricing revenue in real-time, so finance teams always have up-to-date data.

- Seamless handling of contract modifications: RightRev manages changes like renewals, pricing adjustments, and multi-year agreements, minimizing the risk of errors.

- Built-in compliance controls: The platform includes controls that ensure full adherence to IFRS 15 guidelines, providing peace of mind during audits.

- Automated allocation of transaction prices: RightRev automatically allocates transaction prices based on SSP, reducing manual calculations and ensuring accuracy.

- Comprehensive audit trails and reporting: RightRev’s user-friendly interface allows accounting teams to access clear audit trails and detailed revenue reporting, supporting compliance with financial standards.

Future-Proofing Revenue Recognition for SaaS and Software Companies

Automating compliance with IFRS 15 software is essential to reducing risk, improving efficiency, and streamlining audits. SaaS companies relying on manual spreadsheets face too many complexities and the risk of costly errors.

Without automation, SaaS companies struggle with:

- Manually tracking errors, leading to revenue misstatements

- Time-consuming contract modifications and revenue reallocations

- Inconsistent reporting, increasing audit risk

With RightRev, revenue recognition becomes faster, error-free, and fully compliant. To take the next step toward revenue accuracy and compliance, request a demo today.