Closing the books is an arduous process for any accounting team, requiring meticulous organization, attention to detail, and often a mountain of paperwork. However, your accounting close process can be streamlined and accelerated with the right processes in place and leveraging technology. This blog will discuss how to speed up your accounting close process and get the books ready faster with RightRev.

What is the Accounting Close Process?

The accounting close process is the process that takes place at the end of the accounting period to create the financial statements of the organization. These statements are reported on a monthly or quarterly basis. The revenue accounting close process includes running revenue reports, consolidating data for reconciliation, creating journals and adjusting entries, and more. For many organizations, the accounting close process usually lasts 5-10 days, and it’s a time-consuming task with many steps and dependencies. The accounting close process is the final stage of the accounting cycle. It is the period at the end of the accounting period when the financial statements are finalized.

How to Close the Books Faster with RightRev

RightRev is a modern revenue recognition solution that helps businesses close their books faster. By generating 160+ real-time metric points when transactions occur, users can close the books much faster than relying on the traditional process of waiting until the end of the month to run reports. This process begins with RightRev automatically generating over 160 revenue metric points to provide customers with complete visibility into the revenue projections, which can be broken down into many levels according to their needs.

RightRev offers different currencies and a range of metrics, such as:

- As of Date

- Period to Date

- Quarter-to-Date and Year-to-Date Revenue

- Revenue to be accounted

- Earned Revenue

- Unearned Revenue

- Overall Bookings

- Overall Billings

- Usage Bookings

- Usage Billings

This data helps customers make quick decisions and gain an accurate 360-degree view of their revenue information.

The process is completely automated, as journals are generated in real-time when any revenue contract changes are made. This eliminates the need to generate journals in multiple steps and provides customers with real-time information for their GAAP Reporting to understand its impact on the opening and closing balances for a given period. In addition, with RightRev, journal entries are automatically sent to the General Ledger via API integration upon closing. You can close your revenue books separately from billings and control the closings by Legal Entity.

The best way to get ahead of the curve is to implement an automated solution. By using RightRev to automate the close process, our customers have seen a significant reduction in the time it takes to close the books. We’ve seen customers reduce their time to close the books from two weeks to one or two days.

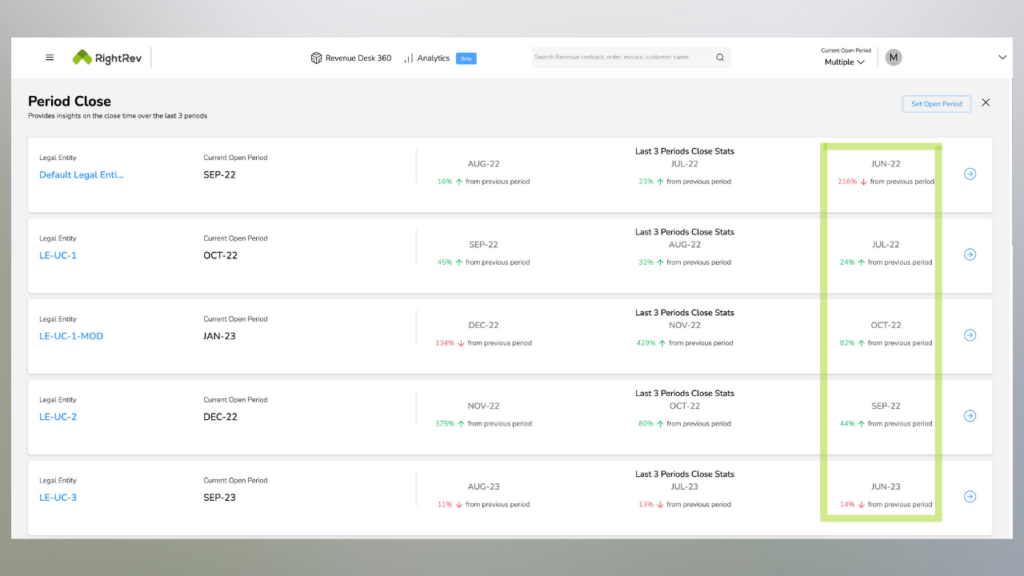

RightRev released a new feature not seen in any other revenue recognition automation solution. The Period Close Report provides insights into the close time over the last three periods. Customers can track how long it takes to close the books. In addition, our team will reach out to customers if we notice the time to close your books is not decreasing. Our account managers will help you find ways to achieve a faster close.

RightRev is the first revenue recognition product to offer metrics on closing the books, allowing revenue teams to waste less time on month-end close and focus on strategic ways to help grow your business.

Advantages of Speeding up the Accounting Close Process

When you’re as busy as most finance and accounting teams are, closing the books as quickly as possible is a must. In addition to being more efficient and effective, there are several other advantages to speeding up the accounting close process. By doing so, you’ll be able to:

- Maximize the value of your accounting data and insights

- Report complete and accurate financial data faster, which helps support your organization’s decision-making needs and increase the value of your accounting insights.

- Minimize the risk of missed or inaccurate data. Reporting incorrect data leads to a greater risk of delaying the close process. This can lead to a lack of trust in your organization’s financial data and poor decision-making.

- Reduce the amount of time that finance is a source of disruption. Quickly completing the accounting close process allows the finance team to be less of a disruption to other departments. This can help you work more efficiently and support your organization’s strategic initiatives.

Overall, RightRev is a powerful and efficient revenue recognition software that helps customers close their books faster and more accurately. Our comprehensive metrics and automated process make it the perfect tool for businesses needing to close their books quickly.

If you are having to close the books using manual processes due to using spreadsheets or system limitations with your current provider, you can quickly access all of the revenue reports you need in real-time with RightRev. Request a demo to see all of our revenue recognition capabilities.

Follow RightRev on LinkedIn to see more rev rec insights.

PS- The answer to the trivia question from our email newsletter is: A) Assets = Liabilities + Equity

This is the fundamental accounting equation that ensures every transaction maintains the balance in double-entry bookkeeping.