The risks—and rewards—of buying revenue recognition software are high. Make the right choice, finance becomes an enabler of growth, not a barrier, and revenue reporting becomes a seamless part of the operation. If you get it wrong, the consequences can ripple across the organization, even leading to dire outcomes like financial restatements or regulatory penalties.

For growing companies, the stakes are exceptionally high. Revenue reporting is increasingly scrutinized by management and investors, making revenue accuracy and efficiency a must-have. Error-prone spreadsheets hinder growth and scalability.

Growing companies seeking to automate revenue recognition must navigate a wide-ranging market of software solutions ranging from ERPs to point solutions. RightRev stands out as the partner growth companies can trust to meet these demands while delivering scalability and accuracy in revenue recognition.

Why Revenue Recognition Software Can’t Be an After-Thought

For businesses to understand or present their true financial picture—whether for internal decision-makers or external stakeholders and regulators—their revenue recognition processes must accurately represent recurring revenue for a specific timeframe. However, manual accounting and spreadsheets introduce too many challenges.

Accountants face mounting complexity in revenue recognition as they navigate diverse business models, including one-time sales, annual recurring revenue from subscriptions, usage-based billing, and hybrid approaches. Automating these intricate processes will eliminate manual errors and ensure compliance with ASC 606 and IFRS 15 standards.

Setting aside the inherent risk of manual error, businesses offering bundles, discounts, and similar incentives must account for those complex discrepancies across contracts and within the appropriate accounting period.

Additionally, mid-contract modifications (e.g., discounting subscriptions to incentivize customers not to change service providers) may carry retroactive consequences, such as amending previously recorded revenue or released financial statements.

(If the nuances of these rules seem headache-inducing, RightRev’s ASC Revenue Recognition Guide provides a dedicated yet accessible breakdown.)

Manual Revenue Recognition: Too Slow, Too Risky, Too Many Errors

Even the most attentive accountant performing this work manually and juggling spreadsheets may still have mistakes or oversights that compromise compliance efforts, financial integrity, and operational transparency.

Per one Gartner survey, responding controllers said the increased workload brought on by new accounting regulations contributes to their staff making some mistakes at rates of:

- Daily: 18% of accountants

- Weekly: 33% of accountants

- Monthly: 59% of accountants

For example, manually calculating standalone selling prices (SSP) and revenue allocation percentages for each performance obligation (i.e., an individual, isolated good, or service sold) in a contract quickly becomes complex when sales staff get creative on pricing to close deals.

Moreover, manual accounting requires far too much time and effort, delaying real-time performance insights that decision-makers need.

Conversely, automated solutions offer the best revenue recognition alternatives to manual efforts. According to the same Gartner survey, accounting technology can reduce errors by 75% if it centralizes data into a single dashboard and is easy to learn, use, and customize.

Automated, uniform revenue recognition performed by the right software:

- Simplifies regulatory compliance and streamlines general processes

- Speeds up account balancing ahead of each cycle’s close

- Produces reports faster to better guide internal decision-makers

- Instills confidence in external stakeholders via improved transparency

- Scales alongside operations without requiring more work hours or hires

Key Features to Look for in Revenue Recognition Software

Selecting the right revenue recognition method and software is crucial to maintaining financial accuracy and compliance. But what key features should you look for when considering the different solutions?

✓ Automated Compliance

The most important feature revenue recognition software provides is automated compliance with standards like ASC 606, IFRS 15, and the Generally Accepted Accounting Principles (GAAP) (including the revenue recognition principle) through uniform, accurate revenue recognition. Given the numerous updates to FASB-published standards as one example, the software should also continually adapt to evolving regulatory changes.

Beyond helping ensure revenue recognition compliance, evaluations of any software shortlist (particularly cloud-based services) should consider the vendor’s and platform’s data security measures and controls. One of the easiest ways to check this is to confirm whether a vendor actively maintains SOC compliance (SOC 2, in particular).

✓ Revenue Model Diversity

A versatile revenue recognition system supports diverse revenue models, including SaaS subscription management platforms, milestone-based contracts, and usage-based revenue streams, to name a few. It is essential for revenue recognition software to accommodate various revenue models as your organization may acquire or build new products or adopt new business models in the future.

SaaS companies and other industries with service-based models particularly benefit from this adaptability, allowing them to align monthly recurring revenue recognition with different performance obligations.

✓ Integration Capabilities

Similar to how automation improves and streamlines revenue recognition processes, integrating revenue recognition software with existing financial systems helps streamline broader accounting and related operations.

Working from a ‘single source of truth’ that syncs data across a business’ tech environment further streamlines processes via improved automation, minimized errors, and all personnel working from the same, up-to-date information.

Among common systems, revenue recognition in ERP solutions like NetSuite or CRM solutions like Salesforce remains critical. For example, integrating with Salesforce helps align data across sales contracts and billings and recognize revenue all in one platform. Similarly, many companies still rely on their ERP system to facilitate many accounting tasks, but the software generally falls short for businesses with complex revenue recognition needs.

Remember that dedicated, pre-built connectors aren’t always necessary; API-based integration capabilities can facilitate seamless connections to revenue recognition software and upstream contract management systems.

✓ Real-Time Reporting

Access to real-time analytics through a centralized dashboard enhances forecasting, compliance, and decision-making. Up-to-date financial data allows a business to assess its financial health and performance in granular detail, which substantially helps with challenges like managing deferred revenue.

Some of the most important reporting capabilities to confirm relate to metrics impacting or impacted by revenue recognition for historical data comparisons and long-term planning, such as:

- Deferred Revenue Waterfall

- Revenue Waterfall By Contract Line

- Remaining Performance Obligations

- Revenue Contracts Rollforward

- Revenue Contract Modifications

- Revenue Contract Billing Details

- Revenue Contract Distributions

- Revenue Contract Details

- SSP and Allocation Report

- Contract Asset vs Contract Liability

✓ Scalability

As your business grows, other revenue recognition methods—like the sales basis method—will scale accordingly. Software that handles increasing transaction volumes without compromising performance is crucial for maintaining efficiency during expansion.

You may introduce new products now sold in bundles, offer discounts for bundles, or offer usage pricing as part of a new AI feature. The intricacies of growth will open up the need for advanced revenue recognition software to account for the various new use cases. Be sure to inquire how quickly the software can process your monthly transactions.

It is critical to consider your current and future-state use cases as you evaluate the capabilities of revenue recognition software. Ask about advanced use cases and if they require software customization. Customizations can lead to higher costs and longer implementations.

✓ Out-of-the-Box Features

Ensure the revenue recognition software on your shortlist provides the out-of-the-box features to minimize the need for expensive custom development or complex configurations.

The chosen platform should also support different revenue recognition methods, have advanced reporting capabilities, create journal entries, and share revenue journals with your general ledger at a minimum.

✓ Implementation Effort

Be sure to consider the level of effort involved in implementing the software. Ask the vendor if there are pre-built templates that make data migration faster and easier. Does the company offer resources to assist you throughout the entire implementation? If something seems too good to be true, it probably is.

How to Evaluate the Best Revenue Recognition Solution for Your Business

Selecting the best revenue recognition software is a huge decision. It directly influences the company’s financial integrity and compliance with accounting standards. So, how do you narrow down the different platforms to a final shortlist?

Assess Your Business Needs

Evaluate your current and anticipated revenue models, key compliance challenges, and long-term goals. Your assessment should include an analysis of existing contracts, pricing structures, and the complexity of performance obligations. Remember to consider your industry’s specific compliance requirements.

Create a Feature Checklist

Start by identifying your most pressing pain points and bottlenecks. Develop a detailed feature checklist to distinguish between must-have functionalities and optional features. Prioritize those that help ensure compliance with your most relevant accounting standards and support scalability to facilitate future business growth.

Research and Compare Solutions

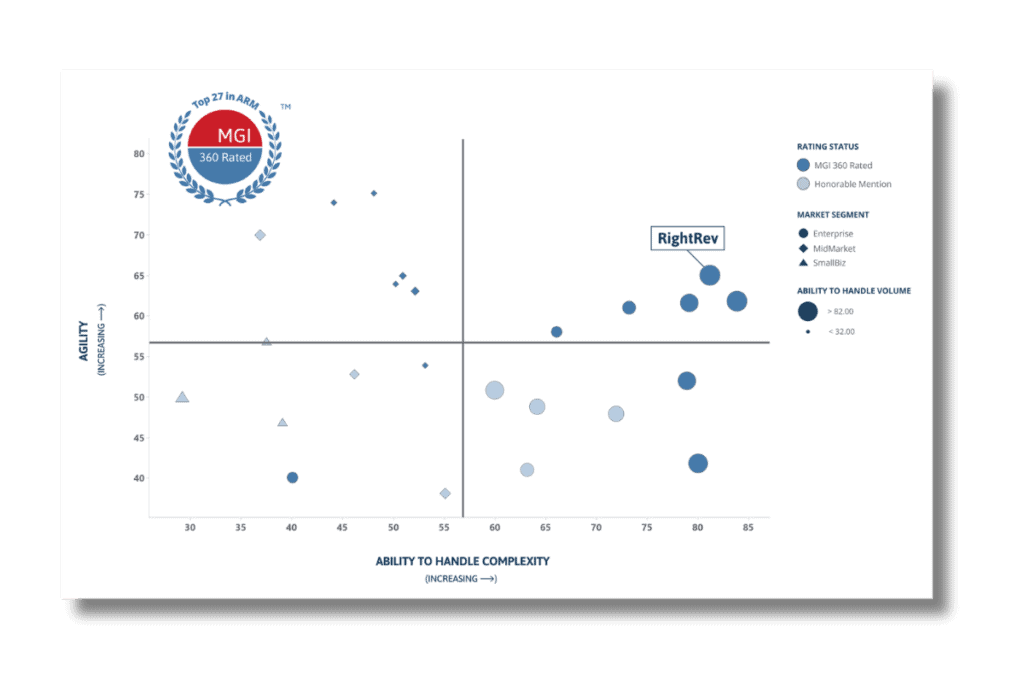

Research potential software solutions, such as case studies and comparison websites, to assess each option’s strengths and weaknesses. See how RightRev stands out as a leading revenue recognition software solution by downloading the MGI 360: Automated Revenue Management Buyer’s Guide.

Involve Key Stakeholders

Always engage key stakeholders from finance, IT, and compliance departments early in the evaluation process. Their input can be vital to ensure the software aligns with tech requirements and regulatory, financial, and strategic objectives.

Check Customer Support and Training Options

Last but not least, you should evaluate the customer support and training resources offered by potential software vendors. Responsive support services and comprehensive, accessible training materials are essential for a smooth onboarding process.

However, don’t forget that ongoing training and services will assist you once your team gets up and running.

Top Revenue Recognition Software Providers

Now that you know what to look for when selecting the right revenue recognition software, where should you start?

Top Choice: RightRev

According to a recent analytical report from MGI Research, RightRev is rated among the top solutions. It offers automated revenue recognition, compliance with important accounting standards, and comprehensive dashboards for monitoring real-time insights.

RightRev serves as the revenue recognition software of choice at companies like Epicor specifically because it integrates with CRMs such as Salesforce, making accounting, reporting, and compliance streamlined and simple.

Choose RightRev for Streamlined Revenue Recognition

Choosing the right revenue recognition software will provide growing businesses with the foundation to automate, optimize, and simplify financial processes and accounting compliance—all while providing greater transparency for stakeholders through financial statements.

With the right tools, you can focus on growing your business rather than wrestling with revenue recognition.

To learn more about what RightRev will do for your business, browse our frequently asked questions or contact us to start exploring our solution with a revenue recognition demo.