Tax, accounts receivable, accounts payable, reporting, and revenue—corporate accounting is certainly a multifaceted discipline. Revenue recognition accounting stands out as one of the most critical and challenging functions.

As defined by regulatory bodies like the International Accounting Standards Board (IASB), the core principle of revenue recognition is that revenue is recorded when goods or services are delivered.

That can be a problem—how do finance teams know when these obligations are fulfilled? While spreadsheets, phone calls, and emails may work temporarily, these methods create compliance risks and major inefficiencies.

This article explores the principles and challenges in revenue recognition, how accounting teams can handle them, and why automation is the key to overcoming manual errors and inefficiencies.

What Is Revenue Recognition in Accounting?

How do you determine your organization’s financial health? Revenue recognition aims to help answer that question by recording revenue once earned, not just when cash hits the bank.

According to the Financial Accounting Standards Board (FASB), this method (also known as accrual accounting) is the preferred means of tracking revenue for SaaS companies. Why is this method so effective?

Here are a few reasons:

- It ensures accurate reporting by aligning revenue with the period in which it was earned.

- It clarifies financial planning and forecasting by preventing artificial spikes in revenue from large contracts.

- It maintains compliance with regulations such as Accounting Standards Codification (ASC) 606 and International Financial Reporting Standards like IFRS 15.

For example, imagine a SaaS company that signs a three-year enterprise deal worth $900,000. Depending on the agreement, revenue may be recognized either when the customer pays or when performance obligations are met.

While the customer pays the full amount upfront, GAAP rules require the company to recognize that revenue over the 36-month contract period—$25,000 per month—not all at once.

Things get even trickier if the deal includes tiered pricing, usage-based add-ons, or performance obligations that span different product lines or services. Manually tracking all of this across spreadsheets can quickly become error-prone and unsustainable—which is where RightRev steps in.

The RightRev platform automates complex revenue calculations in real-time, ensuring you always have on-hand access to your current revenue situation.

Why Revenue Recognition Matters for Businesses

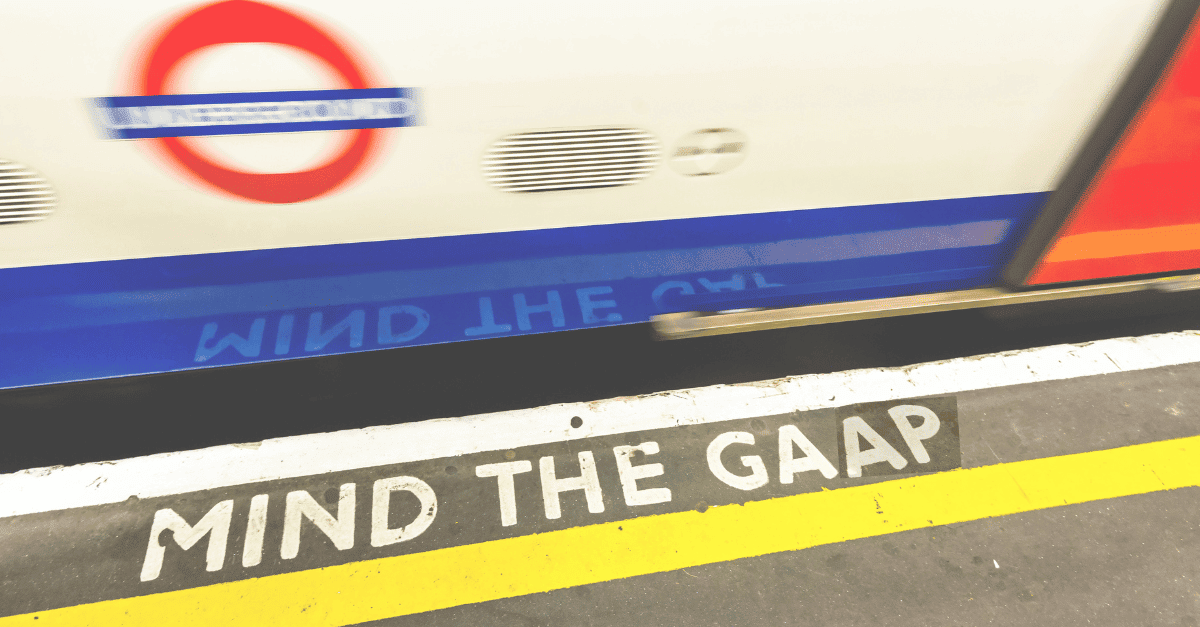

For most businesses (publicly traded companies or those averaging $25 million or more revenue over three years), revenue recognition practices must comply with Generally Accepted Accounting Principles (GAAP).

To uphold standardized and transparent reporting, ASC 606 establishes a five-step framework for recognizing revenue:

- Identify the contract with the customer.

- Define performance obligations and what goods or services you’ll deliver.

- Determine the transaction price (the total pay for fulfilling the contract).

- Allocate and divide this price between each separate performance obligation.

- Recognize revenue once obligations are fulfilled.

Again, this is much easier said than done.

Consider again the SaaS company that collects $1.2 million in revenue annually. On paper, this revenue is recognized at $100,000 per month over 12 months, but in reality, the finance team must also track:

- When each individual subscription starts—identify the contract.

- Bundled or mixed products and services—distinct performance obligations.

- Cancellations, refund requests, discounts, and similar variable consideration payment terms affect the final transaction price.

- Recognize revenue once obligations are fulfilled for each individual customer contract

Trying to manage this manually in spreadsheets is unrealistic as the volume of customer contracts grows. Automation is not simply a “nice-to-have” but a necessity to avoid incorrectly gauging revenue and violating GAAP principles. Automating revenue calculations also supports adherence to proper revenue recognition requirements under ASC 606.

RightRev was built with these challenges in mind. From the very start, the platform simplifies compliance by automating the heaviest lifts, such as performance obligation management, transaction price allocations, contract modifications, and revenue schedules.

Manual vs. Automated Revenue Recognition

While automation may sound promising, is it really worth it over simply closing the books by hand? We would argue for a resounding “yes.”

Modern accounting revenue recognition platforms help companies stay compliant while scaling operations.

Note three ways automation can deliver better outcomes for your accounting team:

| #1. Minimizes Errors | #2. Improves Efficiency | #3. Frees Up Time |

| Manual revenue tracking is a breeding ground for compliance risk, prone to: Spreadsheet errors or mistakes from manual data entry. Inconsistent revenue recognition across departments (“Who has the latest spreadsheet, again?”). Delayed reporting due to fragmented data and the inevitable need to follow up on it. Unreliable revenue recognition in financial reporting, resulting in unclear or erroneous projections. RightRev’s automation eliminates these dangers by implementing a consistent, rules-based revenue recognition process across all sales transactions, ensuring accuracy at any scale. | Manual tracking is time-consuming and resource-intensive, often involving: Endless emails and calls to verify data between departments. Hours spent sifting through spreadsheets, searching for errors. Last-minute scrambling to reconcile end-of-month reports. With RightRev, these inefficiencies disappear. Case in point: Epicor, a software giant, used RightRev to process over 900,000 monthly journal run lines in just minutes—eliminating a previously time-consuming bottleneck. | When revenue recognition is manual and inconsistent, finance teams are forced to: Spend more time on data entry than financial analysis. Question the accuracy of revenue trends. Lose valuable hours on low-impact, repetitive tasks. With readily available and easily compiled revenue data, finance teams can focus on the story behind the numbers without getting bogged down in the spreadsheets that store them. |

Revenue Recognition for Recurring Revenue Models

As previously noted, recurring revenue, whether from subscriptions, usage-based billing, or hybrid models, introduces new revenue recognition challenges.

Note three potential challenges—and how RightRev solves them:

- Contract modifications: A single contract adjustment can trickle down to revenue allocation, requiring constant realignment. RightRev automates this process by automatically allocating revenue (prospectively or retrospectively) and adjusting the revenue schedule accordingly.

- Usage-based billing: Pay-as-you-go works great for customers but not so much for your accounting department. RightRev is designed to handle dynamic calculations for fluctuating pricing structures, recognizing revenue in the right accounting period without unnecessary delays.

- Multi-element arrangements (MEAs): A single contract may include software, hardware, and services—each requiring different revrec rules. RightRev’s automation relieves the burden of manually accounting for every element, leveraging a rules-based system to account for any possible variation of performance obligations.

Unlike rigid ERP systems, which lack the flexibility for a recurring revenue model, RightRev’s adaptable architecture evolves with your business model—whether subscription, usage, or hybrid.

Revenue Recognition Methods Across Industries

As commerce evolves, so do the nuances of how to manage revenue recognition. Emerging industries and business models introduce new dynamics for finance teams across sectors:

- SaaS and software businesses juggle dozens of subscription offerings and upgrades, demanding detailed deferred revenue rulesets.

- Tech and cloud companies are turning to usage-based and hybrid billing models, which require flexible revenue recognition software to calculate the variances.

- Professional services and fractional teams operate on long-term contracts or milestone-based revenue that must be stringently tracked.

Financial leaders need scalable, modern solutions like RightRev to match the ever-growing transaction volumes and evolving revenue streams.

Common Challenges in Revenue Recognition

Critical bottlenecks have emerged due to the gap between industry demands and existing solutions.

While some software solutions attempt to address them, several challenges persist:

- Growing transaction volumes leave legacy systems struggling to keep up.

- Constant contract modification makes compliance an ongoing battle.

- Recognizing revenue timing amidst these variables remains a daunting task.

RightRev’s dedicated revenue recognition platform is engineered to tackle each of these challenges head-on:

- Leveraging automation and rules-based systems allows RightRev to process millions of transactions in minutes.

- Automated algorithms detect the cascading effects of contract changes, correcting revenue schedules for compliant operations.

- Seamless integration into Salesforce provides real-time financial visibility, capturing key data for hands-off revenue recognition.

Preparing for Audits: Where Revenue Recognition Comes Into Play

Auditors can come knocking at any time. Without the right systems in place, a sudden audit could leave your accounting teams racing against the clock to compile the necessary reports.

Financial leadership is responsible for mitigating that impact. CFOs and controllers need audit-ready data based on GAAP revenue recognition principles to prevent compliance risks.

This starts with understanding what auditors look for, including:

- Accuracy in revenue schedules

- What kind of internal controls are in place

- Adherence to ASC 606 standards

- Well-documented revenue recognition policies, logs, and financial statements

In addition to applying best accounting practices, leveraging RightRev’s automated tools is an audit prep game-changer. It delivers the data you need within moments instead of days, aligning with the revenue recognition principle and ensuring financial transparency and accuracy.

With RightRev, finance teams gain:

- Real-time audit trails for full transparency.

- Elimination of manual errors with automated revenue calculations.

- Built-in compliance with ASC 606 & IFRS 15 for stress-free audit protection.

Audits aren’t a matter of if but when. RightRev equips you with the confidence to handle them effortlessly—no last-minute panic needed.

Unlock Revenue Recognition Efficiency With RightRev

Revenue recognition standards are some of the most complex yet essential aspects of corporate accounting.

For most businesses, accurate and compliant revenue recognition isn’t optional—it’s a requirement. Yet relying on spreadsheets and manual tracking makes it difficult to scale, introduces errors, and creates unnecessary stress during audits. Companies must also consider the impact of any changes to the revenue standard and update their processes accordingly.

The solution? Automation.

RightRev is built to handle the complexities of revenue recognition at scale. By automating contract reviews, revenue allocations, and audit compliance, RightRev ensures your finance team can operate with confidence, accuracy, and efficiency—no matter how complex your revenue streams become.

Take control of your revenue recognition.

Request a demo of RightRev today.