As any accountant knows, revenue is more than just numbers on a spreadsheet. Revenue tells a story—about your business, its growth, and the value it delivers to customers.

Net revenue retention (NRR) is one of the most compelling chapters in this story. It identifies the revenue retained from existing customers and isolates factors like account upgrades, downgrades, and churn.

NRR is a powerful metric for subscription-based SaaS companies that highlights growth opportunities, flags potential churn risks, and indicates whether customers are sticking around and purchasing more over time. So, let’s dive into what NRR truly means, how to calculate it, and why it’s a crucial metric for your long-term success.

What Is NRR?

Net revenue retention, also known as net dollar retention, is a metric that shows how much revenue a business keeps (i.e., retains) over time, usually monthly or annually.

Rather than focusing on how many customers are retained or lost, NRR identifies the quality of your revenue retention by zeroing in on how customers’ spending changes over time.

This separates NRR from other metrics such as:

- Gross revenue retention (GRR): Calculate gross revenue retention by measuring your total revenue over a set period without accounting for expansion or churn.

- Annual recurring revenue (ARR): Calculate ARR by measuring the expected total revenue from all active subscriptions or long-term contracts. However, it doesn’t capture the direction your company is heading—growth or contraction.

In contrast, NRR paints a fuller picture of your customer retention.

By identifying positive (expansion revenue) and negative (churn and downgrades), businesses can more clearly discern whether customers are buying more, remaining steady, or gradually drifting away.

Components of NRR

Calculating NRR requires understanding a few core components:

- Beginning recurring revenue: Your baseline is measured in monthly recurring revenue (MRR) or annual recurring revenue (ARR).

- Expansion revenue: Includes upsells, cross-sells, and service upgrades—anything beyond your customers’ usual subscription costs.

- Contraction revenue: Income that hits below the customer’s usual subscription costs, such as what comes from downgrades.

- Churned revenue: Customers who have canceled their subscriptions altogether.

While contraction and churned revenue are useful to track separately, they can be lumped together for simplicity when calculating NRR.

How to Calculate Net Revenue Retention

After gathering the essential components, your goal is to combine them to find a net revenue retention rate—a percentile that summarizes your NRR in a single number.

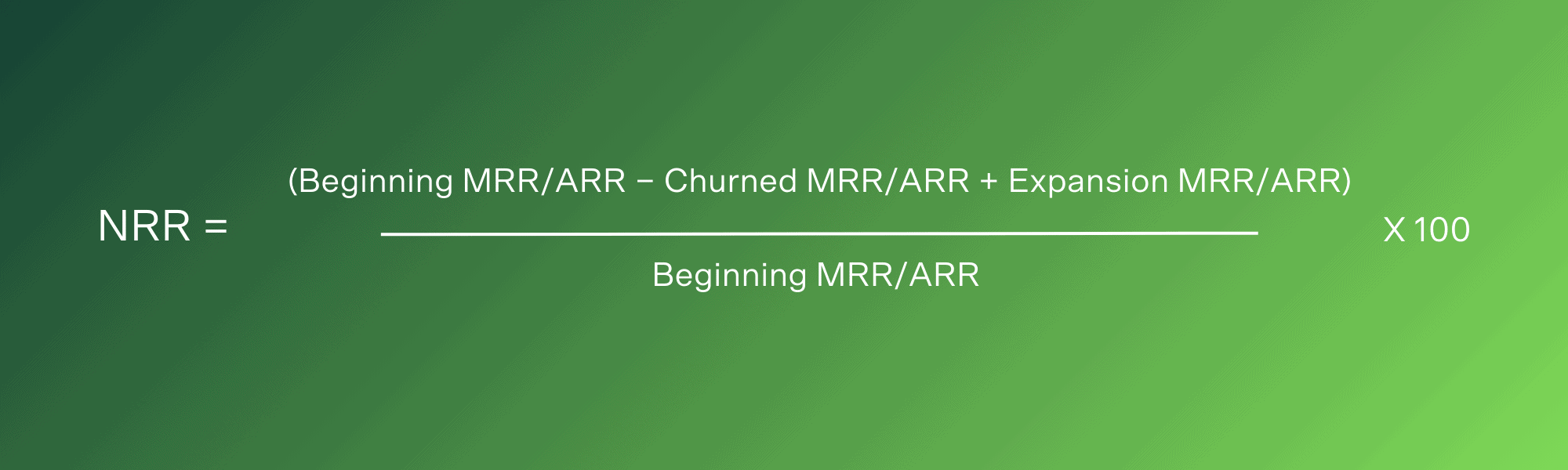

NRR Formula

To find your NRR rate, calculate as follows:

With your MRR or ARR as the baseline, subtract the churn and add expansions from that same period. Divide this total by your starting MRR or ARR, then multiply by 100 to achieve a percentile.

Step-by-Step Calculation

Let’s break it down further with an example. Imagine a company with the following metrics:

- Beginning MRR: $100,000

- Churned MRR: $5,000

- Expansion MRR: $10,000

Following the net revenue retention formula above would result in:

(100,000 – 5,000 + 10,000) ÷ 100,000 x 100 = 105

In other words, the company’s NRR is 105%, indicating that growth is outpacing churn in its existing customer base.

NRR Benchmarks and Best Practices

Like any good story, revenue metrics need context to make sense. This is why net revenue retention benchmarks vary drastically between companies operating with usage-based pricing and subscription models.

Consider some examples in closer detail.

Ideal NRR Benchmarks by Industry

Examining NRR raises an important question: What is a “good” NRR to aim for? Generally, you want to aim for over 100%, which indicates more growth than contraction.

However, the ideal target depends on your company. Notice a few averages in the SaaS industry:

- Consumer-facing: 55% to 80%

- Small business-focused: 80% to 100%

- Enterprise-level: 110% to 130%

These metrics highlight a critical point: NRR is a valuable metric, but it’s not universally applicable.

For example, many AI-powered SaaS platforms operate on usage-based pricing, which isn’t so much recurring revenue as reoccurring revenue. Tracking NRR might not be as effective in these cases since it’s hard to establish a clear baseline.

What to Do if Your NRR Is Low

Data from OpenView shows that NRR (or NDR in this survey) dropped across the board in 2023 as customers tightened their wallets. How can companies adapt?

Consider a few potential strategies for increasing net revenue retention:

- Implement upsells and cross-sells: Existing customers may not be aware of all you have to offer. Identify opportunities to promote complementary products and highlight the value of upgrading.

- Enhance customer support: Strong customer support drives customer loyalty, which is the foundation of NRR. Prioritize customer success at every touchpoint to set the stage for expansion.

- Reduce churn: If your revenue churn is outpacing expansion, consider how to stop the bleeding so to speak. Leverage strategies like targeted surveys to identify and address the problem promptly.

Common Pitfalls in Calculating NRR

Revenue, like any data, can be misleading if presented in the wrong context—or worse, if it’s incorrect from the start. One common mistake is misclassifying revenue components, including one-time fees, into regular recurring revenue.

Timing is also critical. Measuring NRR for a single month could provide distorted data due to seasonal fluctuations. Similarly, failing to align measurement periods with billing cycles can lead to skewed results.

How NRR Impacts Business Growth

While MRR provides a snapshot of financial health, NRR offers deeper insights into revenue movement.

For instance, a company with high customer acquisition might appear financially healthy based on MRR alone. However, there could be significant churn and contraction underneath the surface.

But with a high NRR, you’re more likely to see compounded gains as customer value increases and churn declines, reducing the need for constant acquisition efforts. In fact, many companies publicly disclose their NRR for this very reason.

Unlock Clearer Revenue Insights With RightRev

Revenue tells a story, and understanding its dynamics is key to evaluating your business’s health. Accurately recognizing revenue can provide valuable clarity on performance, growth trends, and areas for improvement.

RightRev specializes in modern revenue recognition methods and automated software, offering real-time visibility into your revenue streams—whether your business operates on subscriptions, usage-based models, or anything in between.

Ready to see how RightRev can enhance your revenue processes? Reach out to our team today for a demo.