As more businesses transition away from single transaction models to increasingly complex pricing and billing structures, Enterprise Resource Planning (ERP) accounting modules struggle to accurately track complex recurring revenue streams—and, needless to say, they fail to do so in real-time.

Businesses rely on accurate, readily available financial data to run their recurring revenue functions efficiently. We’re not just talking about overseeing accounts receivable and other cash management processes. From supply chain management to billing and revenue, accurate snapshots of your financial health let you make more informed business decisions across every department.

Legacy ERP systems built as rigid, all-in-one software struggle to keep up with modern revenue models and the flexibility needed to satisfy the fast adoption of new products, new markets, new selling motions, new pricing models, frequent contract changes, etc. To that end, we’re walking you through the key issues we see with ERP systems and where they fail to live up to today’s standards in revenue management.

Understanding Revenue Recognition Challenges With ERP Modules

One of the biggest issues plaguing ERP accounting systems is the time necessary to implement and customize them. According to a recent study by Gartner:

Over 50% of organizations plan to customize their ERP systems to meet specific business needs.

After all that customization, ERP solutions are often still non-compliant with modern financial regulations. ERP platforms have been around since the 1990s, but modern accounting guidelines such as ASC 606 are much younger. Because of legacy ERPs monolithic nature, adapting their technology to meet new accounting guidelines is a significant product and engineering undertaking, delaying their customers’ ability to comply in a timely manner as they’re beholden to the ERP’s ability to update their software.

In fact, the Financial Accounting Standards Board (FSAB) updated its guidelines as recently as February 2024, meaning ERPs need to be nimble when it comes to regulatory compliance. The rigidity of the ERP and customization requirements often cause businesses to look elsewhere to satisfy their complex revenue recognition needs.

Besides efficiency and compliance issues, ERP accounting software is simply not very effective at recognizing revenue. Let’s take a closer look.

The Limitations of ERP Accounting Modules

ERP software isn’t just time-consuming to implement—running and maintaining your software also requires:

- Data transformation to fit standardized templates

- Manual workarounds—Many processes are handled in spreadsheets, outside of the ERP, when the ERP does not satisfy the customer’s needs.

- Persistent verification of your general ledger

These manual processes convolute data accuracy, leading to the potential for accounting errors and misreporting. Aside from the lack of robust capabilities and the need for manual inputs, nearly half of all businesses find their ERPs to be inflexible to their organizational needs—even after increasing startup budgets and timelines to adjust to their implementation.

In fact, as per Tech Report, when implementing ERPs, businesses:

- Fail 50% of the time

- Spend three to four times as much as they originally budgeted

- Take 30% longer than anticipated for successful launches

Key Features of RightRev’s Revenue Recognition Software

When you implement RightRev into your tech stack, you’ll have accurate revenue data readily available in a fraction of the time of ERPs. Why? With robust out-of-the-box features and real-time reporting, you won’t break the bank (or your back) hunching over and typing up workarounds and customizations just to generate deferred revenue roll-forward reports, for example. We often hear about the reporting headaches associated with ERP revenue modules- having to compile 3, 4, or 5 reports just to understand “What was my opening deferred balance?”

While there are still configurable rules to be set up in RightRev, these will expedite, rather than hinder, your path to accurate financial reports. That’s because recurring revenue management software like RightRev can accurately recognize revenue and generate revenue metrics for complex pricing structures like:

- Consumption-based use

- Ramp deals

- Discounts

- Package bundles

- Rateable billing schedules based on project milestones and Percentage of Completion

RightRev’s intelligent reporting and enhanced data accuracy mean you can rest assured your revenue will be attributed to the right accounting period. Plus, with meticulous attention to ASC 606 and IFRS 15 compliance, you can trust that auditors will be satisfied with your accounting procedures.

Additionally, RightRev was built for Subscriptions and ongoing changes. Subscriptions come with routine contract changes like Upgrades and Downgrades. Accounting teams are left with the burden of manually managing all these accounting complexities without automation. You need a Subscription-focused rules engine that understands contract modifications and automatically allocates revenue for seamless revenue management.

Let’s take a look at Docebo, for example. By consolidating its financial process with RightRev, the company could close its books in half the time of its traditional accounting software.

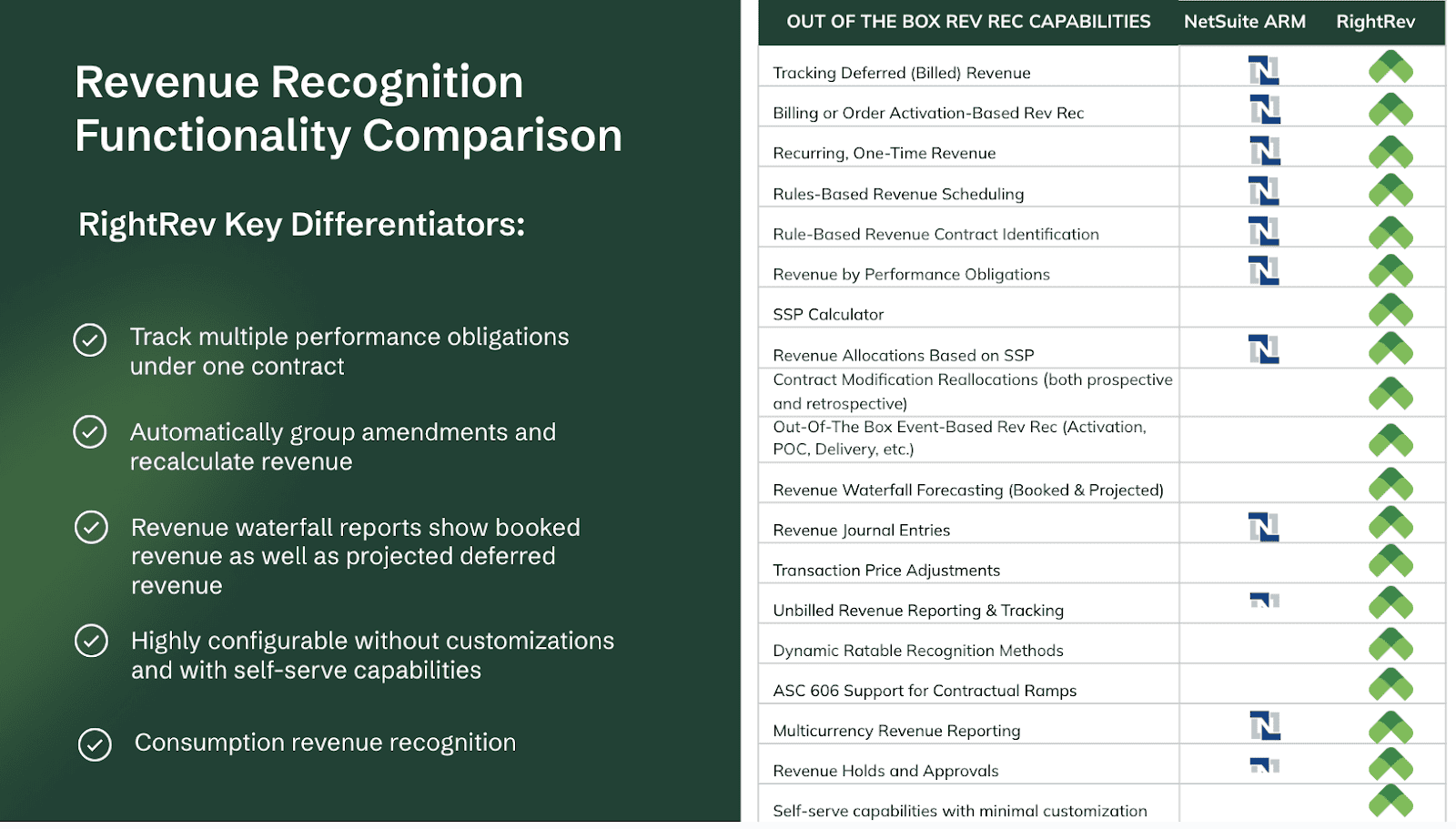

With a 100% alignment with upstream sales data and a singular platform for lead-to-revenue management, Docebo increased efficiency and standardized its processes to facilitate future organizational growth. That wouldn’t have been possible with an ERP’s broad, surface-level capabilities—but with RightRev’s focus on revenue recognition, automating complex accounting procedures became a breeze. As an example, the chart below demonstrates key out of the box functionality for RightRev versus NetSuite ARM:

= partial functionality

Benefits of Using RightRev Over ERP Modules

Implementing RightRev in favor of ERP modules can simplify your accounting procedures and empower you with the accurate, up-to-date financial insights you need to inform your organizational decision-making.

In fact, with RightRev, you’ll:

- Spend less time on manual accounting procedures (such as filling in spreadsheets)

- Improve your financial reporting and accuracy with robust features such as waterfall revenue reports you can sort by month, quarter, or any other metric you desire (versus ERPs where you have to manually combine multiple financial statements to get the same information)

- Seamlessly align intelligent revenue recognition into your tech stack as RightRev functions as a regulatory-compliant revenue sub-ledger where your transactions can be quickly processed and exported as Journal Entries to your existing ERP or General Ledger

Implementation and Integration

As mentioned, with robust out-of-the-box features and high integrability, RightRev can be up and running alongside your existing ERP with little to no customization. Whether you’re using Salesforce as your daily driver, another CRM, or a standard ERP, ready-to-go integrations reduce your company’s time to value and the implementation strain on your IT and accounting departments.

Plus, at RightRev, customer satisfaction is always at the top of mind. We offer training and support every step of the way so you (and the origin of your revenue streams) will never get lost in the shuffle.

From building your first report to setting up robust security measures for your financial data, we have your back as you transfer to a more complete, functional revenue accounting solution.

When It Comes to Revenue Recognition, ERPs Simply Can’t Compete With RightRev

Accurate revenue recognition doesn’t just make your business functions run more smoothly and inform your organizational decision-making—it’s required for some businesses. Compliance with ASC 606 and other accounting guidelines is crucial, regardless of your industry.

While ERP accounting modules claim to cover everything from inventory management to cash management and revenue recognition procedures, they’re just not built to handle the latter’s complexities like revenue accounting automation software such as RightRev.

With a range of out-of-the-box features, easily configurable rules, and the capability to accurately track and post complex revenue streams, RightRev is the leading platform for all use cases of revenue recognition.

Explore RightRev to simplify your revenue recognition procedures, automate complex accounting tasks, and save significant time balancing your books. If you’re ready to take that step, request a demo today.