Revenue recognition, the right way

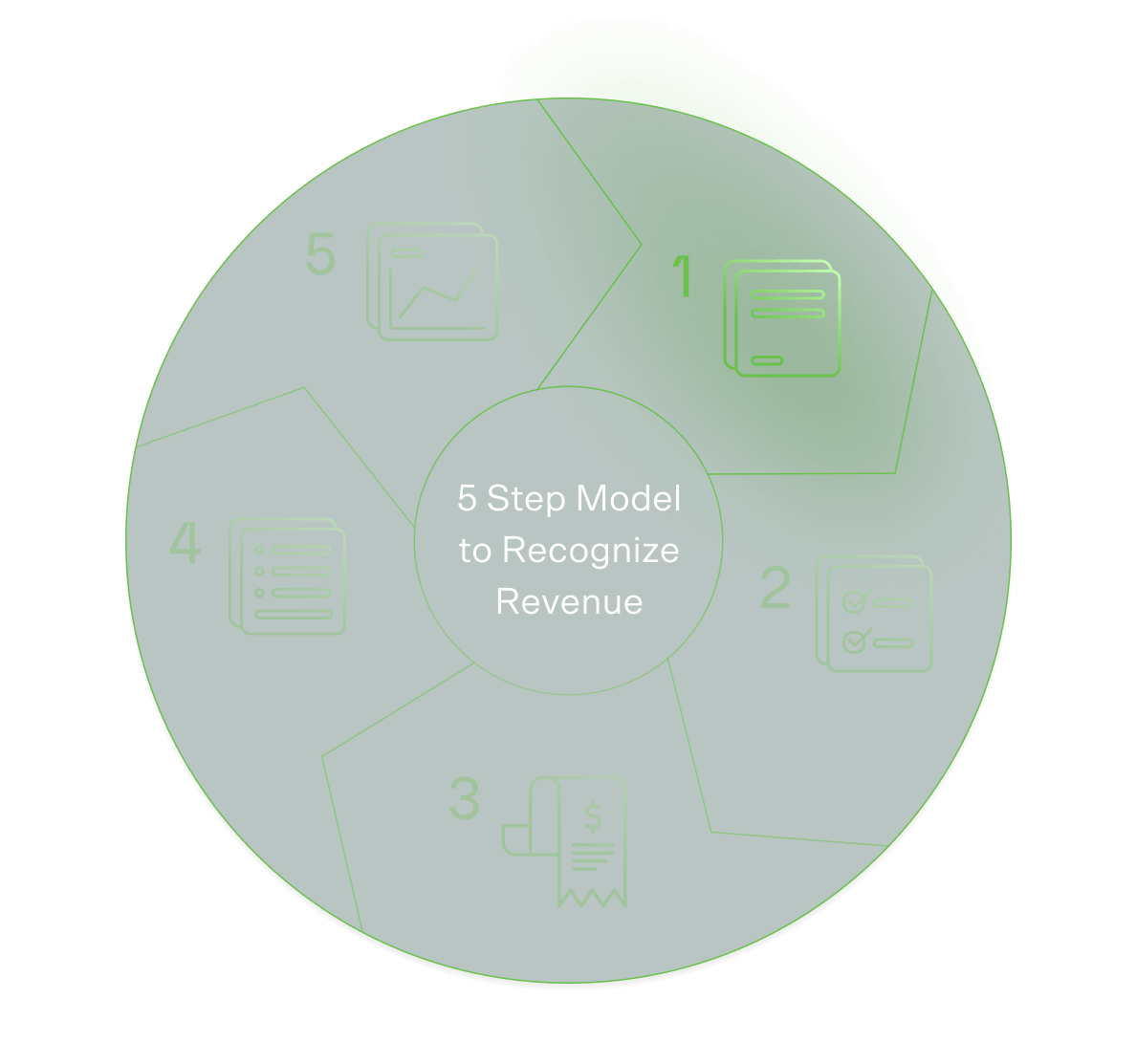

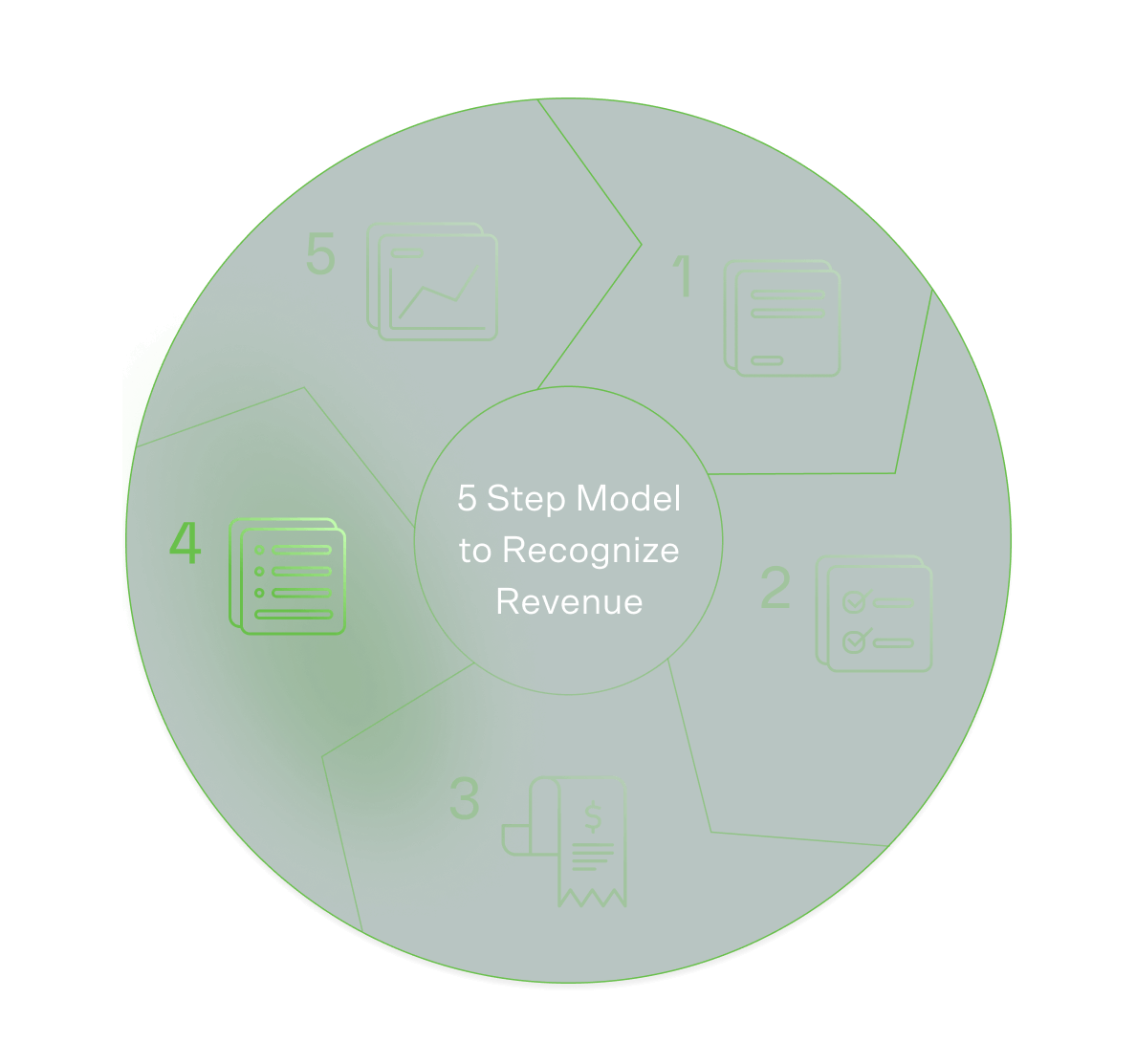

Depending on the nature of your business, ASC 606 and IFRS 15 may have a significant impact on your accounting practices. ASC 606, set by the Financial Accounting Standards Board (FASB) outlines a 5-step model to standardize accounting practices. The revenue policy is designed to increase cross-industry uniformity for financial statements. IFRS 15 is the international equivalent of this standard set by the International Accounting Standards Board (IASB).

As per ASC 606 / IFRS 15, the 5 steps to achieve compliance are:

Satisfy revenue recognition requirements under ASC 606 / IFRS 15…and more

RightRev goes beyond automation for compliance to enable scaling companies the ability to operate with agility and flexibility

-

Configurable Revenue Rules

Configure rules for traditional and modern revenue models. Identify performance obligations within revenue contracts & assign proper revenue rules that apply the appropriate revenue treatment for each separate performance obligation in a single revenue contract.

-

Event-Based Revenue Recognition

Don’t limit revenue recognition to only bookings or billings; instead, configure unlimited events, such as product delivery, completed milestones, percentage of completion, provisioning, etc.

-

SSP Calculation and Analysis

Standalone selling price validation and formula based calculations. Historical analysis of standalone selling prices to automatically determine SSP and apply percentages to Revenue Contract lines.

-

Contract Modifications

Automatically group amendments and recalculate revenue without manual intervention.

-

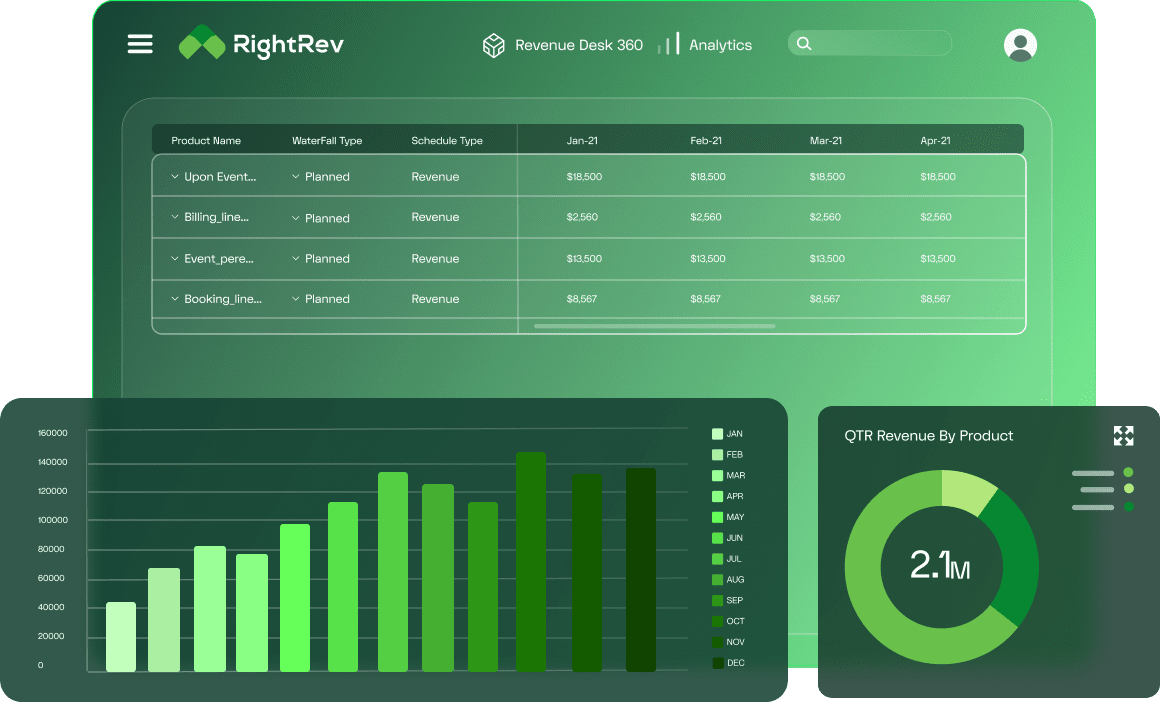

Revenue Reporting and Revenue Waterfall

Out of the box reports to fulfill your reporting requirements, plus hundreds of pre-calculated metrics to enable ad-hoc reporting and dashboards. Revenue Waterfall visibility for planned and recognized revenue.

-

Journal Entries

RightRev integrates with your ERP to automatically post revenue Journal Entries to your General Ledger daily or periodically based on your business needs. You have the ability to defer or release revenue automatically and manually.

Revenue you can count on

Achieve accuracy, compliance, and hyper-scale automation.

-

Revenue Accuracy

Revenue is the most important number on your financial statements…and it has to be right! Eliminate error-prone processes, align sales and revenue accounting data, and have confidence that your revenue is accurate and compliant.

-

Revenue Reporting and Disclosures

Robust revenue reporting and forecasting for planned, unplanned, and recognized revenue help drive strategic insights that create the narrative the CFO can take to the board with confidence.

-

Easy Audits

Minimize audit risk by automating revenue recognition. Eliminate manual preparation for audits and rest assured your revenue is traceable. Easily drill down into product, order, quote details from a Revenue Contract.